How the Future of Manufacturing is Playing Out in the Auto Industry

During the past few years, investors, business executives, and the public have become enamored by innovative technologies and processes that alter the ways goods are manufactured and distributed. Additive manufacturing and 3D printing allow companies to perform rapid prototyping and build to spec. Sensors and IoT-enabled devices gather data, relay it to the cloud, and provide analytics that create efficiencies and secure machines and people in the manufacturing processes. Distributed production networks decentralize the manufacturing process to a network of geographically dispersed manufacturing facilities connected via a shared IT network, enabling a company to control shipping, customize production for regions, or source materials from a variety of locations.

Individually, together, or combined with other manufacturing technologies, these examples are fundamentally improving manufacturing. Production is more streamlined and secure. Critical information, like product costs and available inventories, informs what gets made and when, ultimately reducing waste and unnecessary expense. Ultimately, the combination has accelerated manufacturing processes and outputs, which is changing what constitutes a competitive advantage.

First to market isn’t the advantage that it once was. Meeting customer demand has taken the lead spot. The ability to understand changing market and customer demands and meet them preemptively is a vital differentiator. The ubiquity of technology adoption and desire to move faster has begun to foster cooperation among companies that, historically, have competed against each other.

These ‘competimates’ have begun pooling resources to develop and deploy technologies that they could not otherwise procure or manage on their own. Some of the partnerships are between companies in the same industry, and others may pair complementary organizations. In any case, by joining forces, the manufacturers augment their capabilities to meet demands. They also are tacitly admitting they cannot do it themselves.

This conscientious balance indicates the company is willing to take on the risk of joint ventures related to future technology and IP ownership in exchange for the capacity to satisfy market demands in the immediate timeframe.

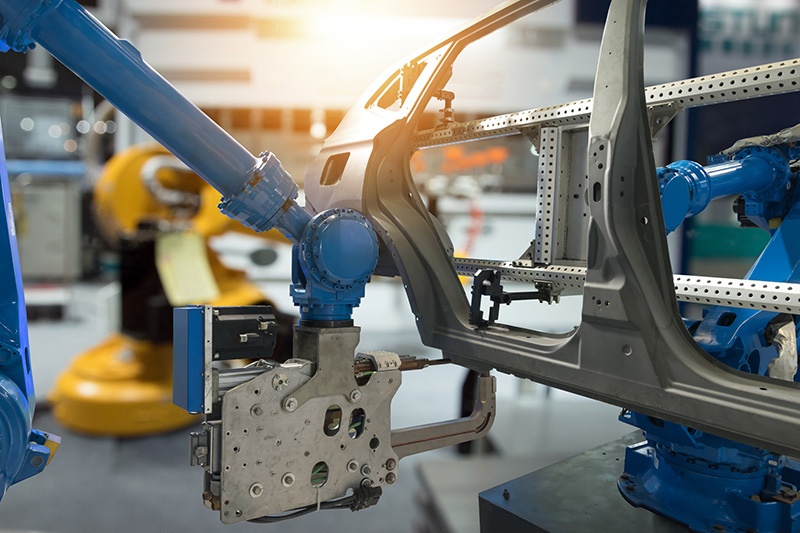

What we are learning from auto manufacturers

The modern auto industry offers one of the best examples of this push and pull. With the rapid uptake of electric vehicles and the pursuit of self-driving cars, these partnerships are forming quickly. The Wall Street Journal recently reported that “auto makers are rushing to forge partnerships on self-driving vehicles, aiming to advance costly technology that many in the industry see as vital to securing their future as consumer preferences change.” [1] The examples are numerous, including:

- Honda’s $2.75 billion investment in the GM Cruise, with the goal to leverage GM’s scale to mass produce a self-driving car in the near future

- A partnership between Fiat/Chrysler and BMW to develop self-driving cars by 2021

- Toyota’s investment of $500 million in Uber to create self-driving cars

As with so many other industries, we also observe the impact of a globalized economy. The international partnerships have their own set of implications related to engaging across borders – including compliance, economics, and politics. The backdrop of the recently agreed-to U.S.-Mexico-Canada Agreement (USMCA) and looming trade negotiations between the United States, European Union, and China adds a layer of nuance and complexity for auto manufacturers.

Inter-company partnerships among companies that would otherwise be competitors might seem drastic. They’re comparatively simple in light of the unprecedented level of involvement of state actors in shaping trade policies. The international collaborations will have downstream effects on strategic decisions the companies will make going forward. For example, the USMCA restricts the percentages of parts can be manufactured outside North America and limits “carmakers’ ability to base production in lower-wage Mexico.” In effect, while a globally distributed production network offers resource and cost benefits to U.S. auto manufacturers, the restrictions put significant limits in place that diminish the potential benefits. [2]

Uncertainty in the new dynamic

Should the United States ratify the USMCA, economists and auto manufacturers predict that the price of autos will rise, though it’s unclear by how much. The answer will be based mainly on the level to which trade agreements, like the one noted above, restrict how companies manufacture and impact the cost of goods sold and the workforce. For manufacturers, this uncertainty translates to debates like whether to accept financial penalties for manufacturing overseas because, even with the fines, the cost is less than manufacturing domestically.

These win/loss deliberations between competition and collaboration, or international and domestic are evidence of the power dynamic at play. First, we observe the emergence of competitors teaming with one another to deploy new technologies, acknowledging that no single entity has the knowledge, capability, or scale to deliver these new products alone. Second, international trade agreements fundamentally alter market drivers that form part of manufacturers’ cost of goods sold and ultimately, determine the price paid by the consumer.

It’s important to observe what will happen. Precedent says that we can expect the example to play out in other sectors of the economy that resemble the automotive industry. Industries that require significant workforce skills, capital expenditures, and advanced technologies, and are subject to varying regulations across the global landscape likely will look much like the auto manufacturing industry. We expect to see parallels in aerospace/defense, agriculture, and pharmaceuticals, to name a few.

Most interesting will be how these industries and the companies within them treat intellectual property and patent rights, especially as multinational corporations continue to form partnerships that leverage capability and scale.

The other consideration to watch is how the U.S. manufacturing sector will evolve. Manufacturing growth in the U.S. currently is stagnant and projected to remain relatively flat through 2023. [3] The outcomes of the near-term decisions of automakers will likely influence the behavior and decisions of companies in other manufacturing sectors. Will they determine it is worth it to accept financial penalties because the tradeoff of domestic labor costs offset the imposition of tariffs?

There’s much we do not yet know. What we do know is that progress in many manufacturing sectors (automotive, most notably) is predicated on the company’s ability to augment its capabilities quickly and cost-effectively. Whether this happens via a partnership with a would-be competitor or a move to engage internationally despite the financial and regulatory challenges remains to be seen. We do know that companies participating in these decisions must develop a wide range of “what-if” scenarios and informed questions, including:

- Are partnerships the best route to achieving scale and generating profitable returns on investments?

- What risks are U.S.-based companies willing to accept by engaging with an international partner to develop a product and go-to-market?

- Who will own IP rights to technologies developed in a cross-border joint venture?

- What cyber protections need to be in place?

- What are the second- and third-order effects of trade policies on global supply chains?

- How will trade policies impact the ability to price competitively?

For any company whose bottom line depends on manufacturing, the agility and security of the company demand that you run scenarios and weigh the answers to questions like these.

During the next few months, we will carefully observe the evolution of USMCA and other international trade agreements. We suggest you do the same. These are unprecedented developments that require senior leaders and executives to examine their business environments without bias and consider the fact that disruption can emerge from anywhere.

It’s time to build a strategy that will equip your production capabilities to participate in an evolving global marketplace.

[1] https://www.wsj.com/articles/honda-to-invest-in-gms-self-driving-car-unit-gm-cruise-1538569503

[2] https://www.omaha.com/opinion/editorial-new-trade-agreement-has-pluses-but-raises-uncertainties-for/article_97ece5fe-2ce0-5beb-879e-f652614097d4.html

[3] https://www.ibisworld.com/industry-trends/market-research-reports/manufacturing

{{cta(’15a7210e-ed4b-4b0e-93ae-5ecae780cc93′)}}

About the Authors

About the Authors