Retirement Reimagined:

Five Themes for Navigatingan AI-Powered Future

Like other leaders from corporations and government entities, retirement plan administrators are curious about artificial intelligence (AI) and its potential impacts. They know change is coming and want to understand how to prepare. I recently presented a keynote address at the California Association of Public Retirement Systems (CALAPRS) annual meeting addressing these concerns. The group, representing retirement plans from across the state, was interested in how AI could potentially impact county and local governments, their employees, and the retirement systems that they manage.

It’s More Important to be Ready than Right

As with all our discussions about the future, we are not making predictions, but identifying potential disruptions that organizations should prepare for. Our perspective is that, given the amount of uncertainty and pace of change, prediction is not a useful exercise. With that preparation mindset, these five relevant themes emerged.

AI and the Retirement System: Five Themes

AI is a Foundational Technology

While it may be easier to see the direct impacts of AI (e.g., jobs affected, processes improved, errors made), to prepare for AI’s full scope of disruptions, it’s best to think past those obvious, direct impacts and explore other indirect downstream impacts. Like other foundational technologies—from the wheel to harnessing electricity to the internet—AI will impact every part of the economic ecosystem. Every industry and government function will explore and implement AI, and the retirement system, as part of that larger economic ecosystem, will be no exception.

We can expect AI to creep into nearly every corner. For example, we can anticipate AI in healthcare changing life expectancies. Longer life expectancies can change how and when people retire. Upon retirement, and probably before that time, low-cost, personal AI can change people’s spending behaviors.

All Actuarial Assumptions Need to be Questioned

Planning, funding, and the solvency of pensions are based on actuarial assumptions. While these assumptions may have been reliable for decades, the impact of AI could significantly impact those assumptions and drastically change actuarial models. Some examples include:

- Retirement Age. As AI impacts various industries and jobs, people may retire earlier if their skills don’t keep up with technological advances or they may be able to retire later if AI enables a longer career through upskilling or accommodating physical limitations.

- Salary Growth Rates. More rapid technological advances mean that valued, in-demand skills will change more frequently. Longer tenure doesn’t always equal greater pay due to those shifts in demand and the likelihood that younger workers will have more experience with and mastery of the latest technologies. Salary curves may look more like sine waves as employees navigate learning new skills and market demand.

- Life Expectancy and Healthcare Costs. Medical advances, especially breakthroughs in common diseases, can radically change mortality rates. AI and data-centric medicine may also shift healthcare costs in situations where better monitoring recognizes diseases earlier or identifies harmful behaviors, personalized medicine may have significant upfront costs but reduce long-term costs with higher efficacy, and AI-assisted patient experience could reduce labor costs.

Task Impact vs. Job Impact

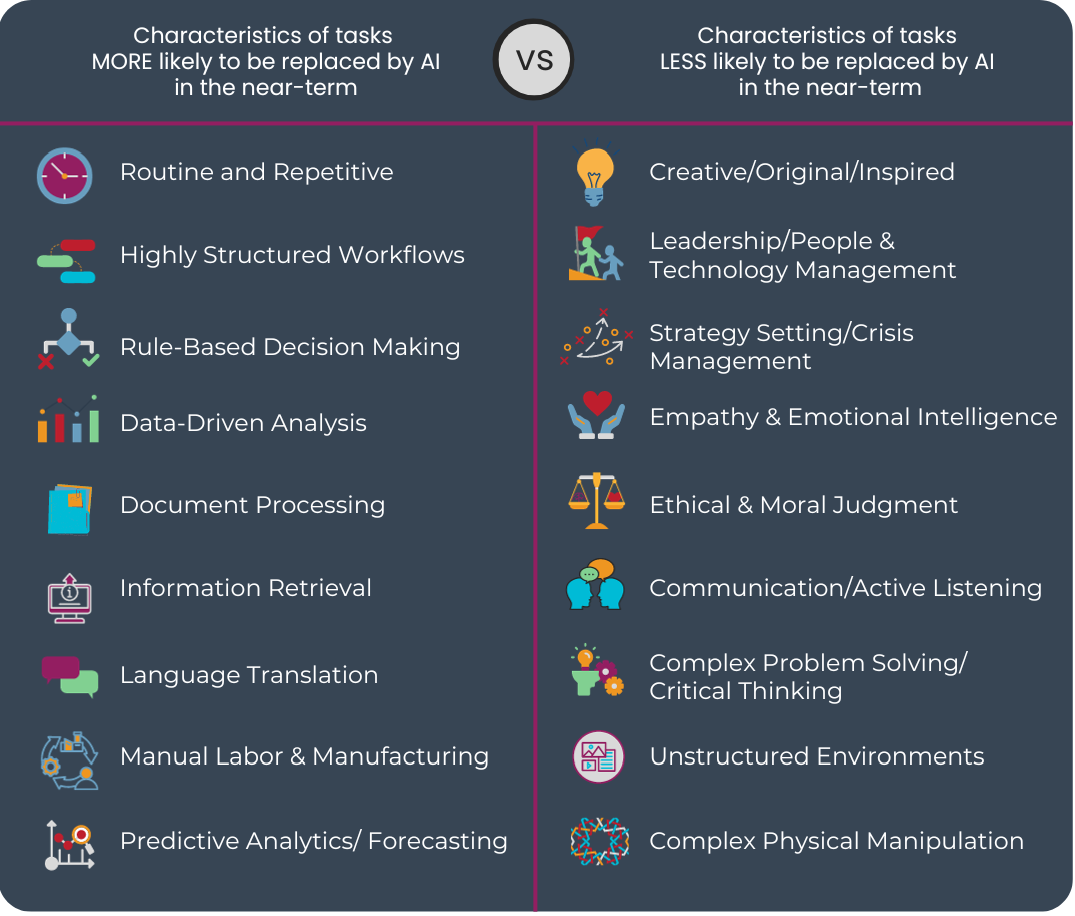

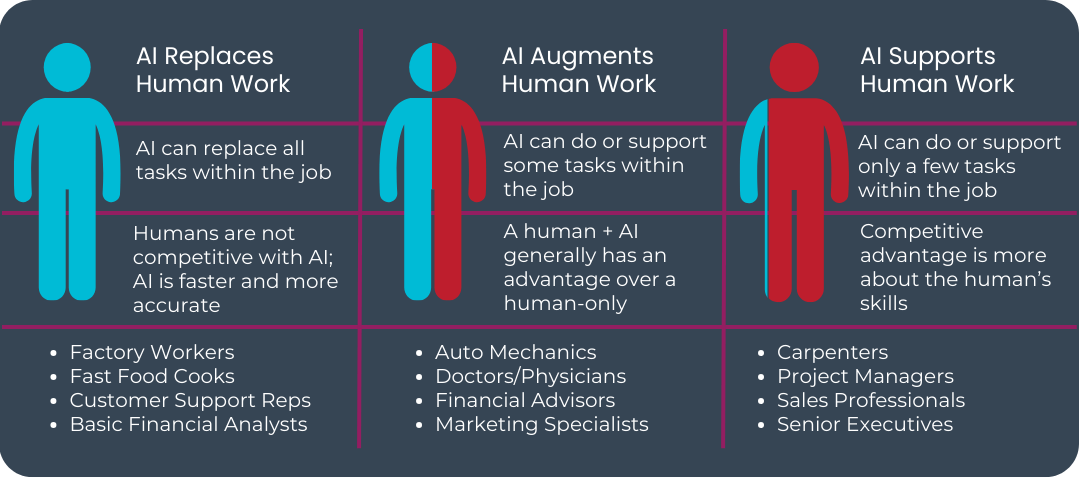

There are many projections about how AI will displace jobs. It is straightforward for jobs comprised with only a few tasks, all of which can be replaced by AI; however, many jobs are made of multiple tasks, some of which may be replaced by AI and others that won’t be…at least in the near-term. Rather than having a binary view of AI’s impact on a job, a better way to analyze the potential impact is to deconstruct jobs into their various tasks and evaluate each task.

As the table below illustrates, a helpful framework for evaluating tasks is by comparing tasks within a job to the characteristics that make a task more likely or less likely to be replaceable by AI.

Jobs can be analyzed by placing them on a spectrum related to key human characteristics to understand how susceptible the constituent tasks are to replacement by AI.

Of course, as employers get a better understanding of which tasks are better done by AI and which are better done by humans, this opens up the workplace for significant restructuring of jobs to optimize the distribution of tasks across machines and humans.

Tax Revenues and Government Expenses Could be Impacted, Too

Tax revenue changes will impact actuarial assumptions but they could also have a more direct impact on the revenues needed to continually fund retirement plans. Similarly, shifts in the commercial profiles within government borders and constituent needs may have both positive and negative impacts to expenses. State, county, and local governments should analyze their revenue sources to determine where the risks and opportunities are given the impact of AI in virtually every industry. Examples include:

Revenues

- Industrial and Retail Tax Base. Reduced demand for manufacturing jobs, shifts in information jobs, and the rise of the service sector can cause meaningful alterations to the tax base.

- Resident Volume, Demographics, and Income. As AI impacts factors such as job demand, commute distances, income growth, and career arcs, the predicted tax revenues may be significantly altered.

- New Revenue Streams. Changes to industrial and resident needs could create opportunities for governments to increase services, permits/licenses, or assets, which can all bring in new revenue.

Expenses

- Efficiency Improvements. AI can enable efficiency improvements to provide the same or more services at a lower cost.

- Infrastructure Needs. The deployment of rapidly changing technologies, such as smart city capabilities, may require significant investments in infrastructure as counties and cities compete for businesses and residents.

Commercial Employment and Government Employment Models Bifurcate

AI advancements and maturity, along with other workforce disruptors, will redefine the employee-employer relationship. The nimblest employers will be able to take advantage of these changes as the employment landscape rapidly—and continuously—evolves. Employers that are not able to keep up with the rapid pace of change could create a meaningful gap between the most innovative and responsive employers and employers who take a long time to adjust to new employer-employee models. This gap in employment environments could create a bifurcation of the employment base between those who desire “modern” employment models and “traditional” ones. Examples include:

The Value of Tenure

Experience within an organization has typically been viewed as very valuable and career paths and compensation models typically award longer tenure. However, as job tenures shrink and many jobs—and the preferences of employees—move more toward project-based, contract work valuing long-tenured employees over short tenure or just-in-time employees may not reflect true value to the organization. Additionally, as employees use AI for support in their jobs, “institutional knowledge” may be something that’s contained within an organization’s AI that all employees can access.

Experience and Levels

Career paths, and the related job levels and compensation, are entrenched in the idea that the expertise needed to lead and manage is highly correlated with time-based experience. However, as technology advances and other innovations change the work landscape, more junior employees may have more expertise in current skills and AI may be better at identifying the soft skills that make better managers and leaders. All of these factors lead to the idea that hard-wired policies that assume age = experience = level may be true in fewer and fewer cases.

Competition for Employees

AI will allow for better matching of candidates to roles, more detailed assessments of skills and performance, and faster assessment and recruiting processes. Organizations who don’t embrace AI-enabled recruiting and AI-supported work experiences, especially those aligned around tenure-based models, will be at a disadvantage for job candidates.

Takeaways and Actions

The two key messages focused on AI and the impact on organizations, were:

- The impact of AI will be pervasive across society and ecosystems, analyzing both direct and indirect impacts to specific jobs and industries will allow organizations to see a broader range of disruptive surprises.

- In addition to AI being a catalyst for change across the ecosystem, organizations need to plan for many other disruptions to minimize the negative impacts. From changes in workforce demographics to geopolitical shifts to climate policies, many uncertainties exist in the future.

To respond to this uncertain and build resiliency in organizations, we discussed two specific actions:

- Identify and Explore Potential Disruptors. Using an ecosystem view, determine what changes and disruptions may occur and analyze the impact they would have on a particular organizational entity, its stakeholders, and its employees. This analysis should explore multiple scenarios to counter myopic planning around one assumed future.

- Analyze Assumptions. It’s helpful that retirement plans are built around specific, well-defined actuarial assumptions (e.g., life expectancy, retirement age, funding amounts, healthcare costs). As noted above, changes in the future may have significant changes to these assumptions beyond historical ranges. Mapping out the effects of disruptions and the sensitivity retirement plans have to large changes to assumptions will help retirement plans understand what disruptions to watch for and what actions should be taken to ensure resiliency of the plans. This idea applies to any organization, which all have their plans built on layers of assumptions. Decomposing those layers allows an organization to recognize its strategic frailties and build resilience.

Acknowledging that the future may be much different than the past is the first step in the process. This allows for thinking that is unconstrained by history and open to preparing for new realities.

About the Authors

About the Authors