POLICY STORM SEASON: HOW WILL IT IMPACT RELIABILITY, AFFORDABILITY, AND SUSTAINABILITY?

In 2025, uncertainty is the new operating baseline. The grid infrastructure is aging. Power generation is more diverse and dynamic than ever. Supply chains remain volatile and unpredictable. And the rapid proliferation of data centers—driven by AI, cloud computing, and digital services—is pushing demand to record levels. The Department of Energy reported in late 2024 that data center electricity use could triple by 2028, with projections for a 128 GW increase in demand over five years.

Now, add to this already brittle environment a wave of federal policy shifts. The Trump administration’s first 100 days have redrawn the energy landscape, often favoring fossil fuel infrastructure while withdrawing funding for climate resilience and clean energy innovation. These changes have introduced both new risks and new opportunities—and they demand agile, forward-looking responses.

What We’re Hearing from Utility Executives

Toffler Associates recently interviewed over 25 electric utility leaders across the country. Their feedback, shared on a not-for-attribution basis, describes a sector at a strategic inflection point.

Power Demand and Supply Dynamics

- “Green, reliable, cheap—you can’t have all three.” This is no longer a caution—it’s a constraint that leaders are actively managing.

- Utilities are seeing customers become competitors or investors, particularly through behind-the-meter solutions and data center-driven grid investments.

Federal Policy Shifts

- Many utilities are adjusting expectations around IRA tax credits, acknowledging that, while they remain law, their full execution is in question.

- New policies under Executive Order 14156 support expansion of coal and gas for baseload reliability—particularly for AI data centers—marking a significant tilt away from decarbonization goals.

- The $20B freeze of the Greenhouse Gas Reduction Fund and cuts to programs like FEMA’s BRIC will slow local resilience efforts.

Supply Chain Strains

- Transformers: lead times now 4–5 years with price increases of 4–5x. Orders are vulnerable to reprioritization based on bid size.

- Battery storage: Tariffs are making it increasingly slow and expensive to import batteries from China and South Korea.

Strategic Risk Management

- Some utilities are de-risking grid investments by requiring direct contributions from hyperscale data center developers.

- One utility implemented a rolling two-year capital project planning horizon with monthly executive reviews to stay nimble in a shifting risk environment.

Emerging Technology Bets

- Deep geothermal and small modular nuclear reactors are gaining momentum as continuous, dispatchable sources.

- Solid-state transformers offer promise but remain a decade from viability.

We are hearing is that this is a moment unparalleled in modern history in which a variety of drivers of change are creating opportunities and risks. To succeed, strategies need to focus not just on the most urgent crisis, but instead build resiliency against all. It’s worth focusing in particular on the recent changes in federal policy, which are creating a bewildering variety of headwinds and tailwinds for the utilities sector.

How Policy Is Shifting the Utility Playing Field

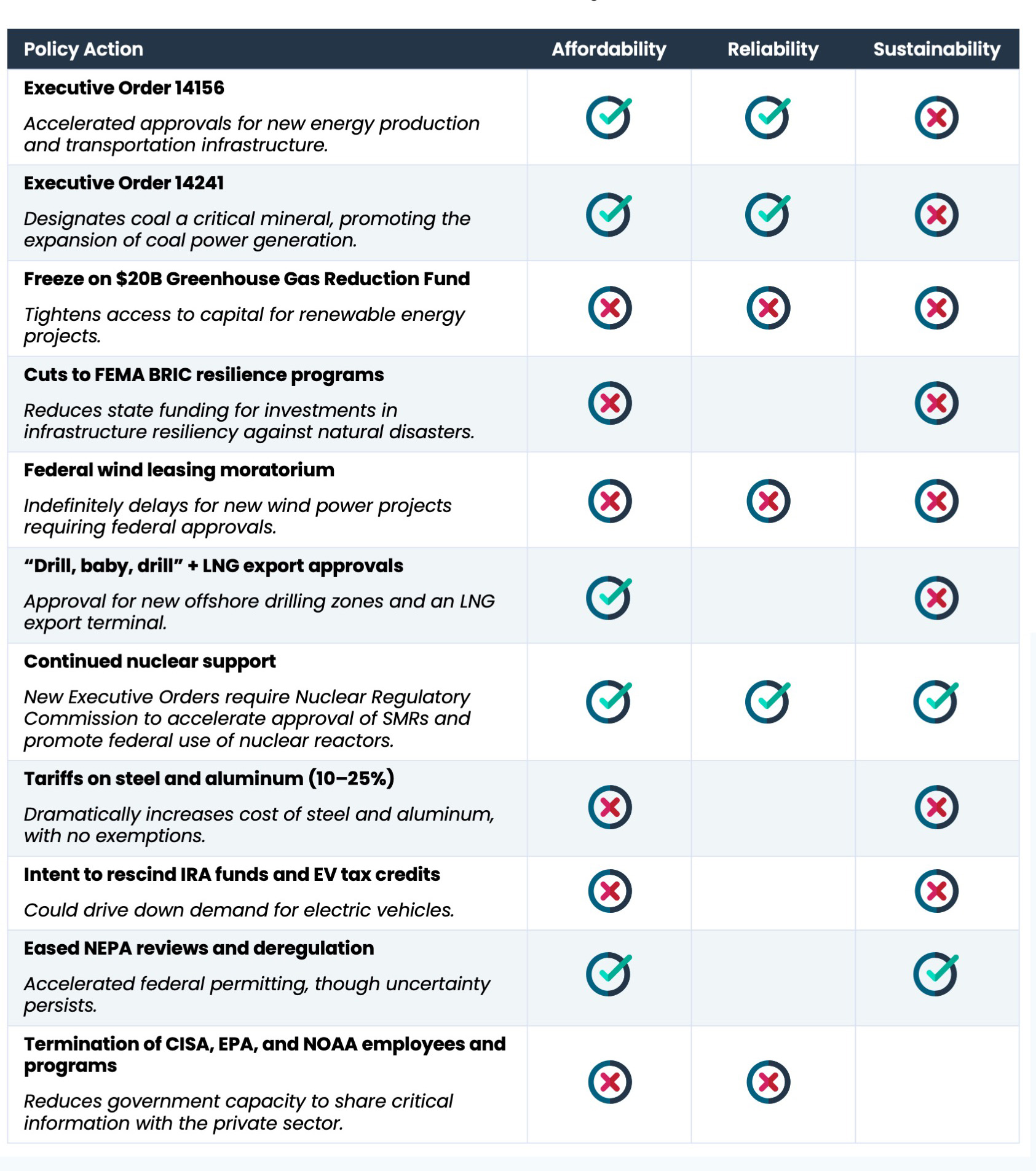

The following table summarizes early Trump administration actions and their effects across our three core priorities: affordability, reliability, and sustainability.

The sum of these policy impacts is a shifting strategic landscape for utilities strategic planning. Many, for example, negatively impact sustainability priorities – but pro-nuclear policies favor invests that may improve sustainability, and NEPA relief could make it easier to invest in new renewable energy projects…while steel and aluminum tariffs are a factor in the model for any new construction. The strategic challenge posed by these policies is heightened by their uncertain longevity. Strategic plans need to account for a wide range of interactions between policies that may strengthen or diminish over time.

Strategic Questions Utility Leaders Must Now Confront

While policy volatility continues, the broader transformation of the utility sector cannot wait. It’s time to activate adaptive decision-making and resilience planning. Toffler Associates helps leadership teams do this through strategic tabletop exercises (TTX) designed to stress-test key assumptions and expand thinking across plausible futures.

Here are six critical questions for utility leaders to explore in a tabletop exercise:

- Dynamic Decision-making: How can your leadership make capital-intensive decisions under shifting political and market constraints?

- Ecosystem Orchestration: Are you ready to become a value orchestrator, integrating distributed energy resources and customer-sited assets?

- Sustainable Business Models: What revenue strategies will keep your utility solvent as traditional funding declines?

- Resilient Decarbonization: How can you pursue emissions targets without sacrificing service affordability or grid stability?

- Digital Transformation: Are you managing assets—or optimizing them through real-time data, AI, and predictive analytics?

- Adaptive Capability: Does your workforce and culture support rapid adaptation to new threats, such as drone incursions, Volt Typhoon cyberattacks, or state-level regulatory shifts?

In this moment of transformation, utility leaders must ask: Are we navigating change—or reacting to it?

The path forward requires courage to challenge legacy planning assumptions and commitment to invest in organizational adaptability. Tabletop exercises and foresight-based planning aren’t luxuries—they are necessities in 2025 and beyond.

Toffler Associates stands ready to help your leadership team prepare for what’s next—before it’s urgent.

Let’s ensure that no matter which priority—reliability, affordability, or sustainability—takes the lead in this moment, your organization is ready to win the future

- Categories

- Security and Resilience

- Strategic Planning

About the Authors

About the Authors